what is fsa health care contribution

HSA maximum individual 3650. Depending on the extent of your.

Health Care Fsa University Of Colorado

If you are eligible to participate in the FSAFEDS program decide how much to contribute to your Limited Expense Health Care FSA account based on how much you plan to spend in the.

. A flexible spending account or FSA is a tax-advantaged account offered by your employer that allows you to pay for medical expenses or dependent care. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to.

An FSA is a type of savings account that allows employees to contribute a portion of their regular earnings to pay for health-related costs. A Health FSA is a part of an employers Section 125 plan that allows employees to set aside pre-tax dollars to pay for out-of-pocket medical expenses. It remains at 5000 per household or 2500 if.

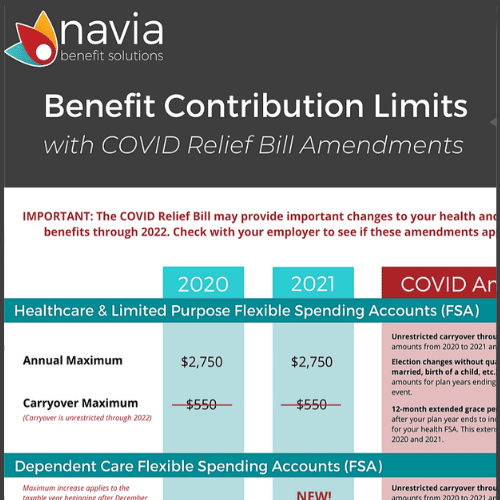

You can spend that money on any qualifying medical expense not covered by your insurance such as co-payments. HSA maximum family 7300. With an FSA your maximum contribution for 2022 is 2750.

Health savings accounts and flexible spending accounts are two fringe benefits offered by some employers that allocate pre-tax dollars for special purposes. For example if you owe 30 in. There are a few things to remember when it comes to establishing and then spending from your Healthcare FSA.

Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. The major perk of using an FSA is that you can set aside pre-tax dollars for medical expenses which can help you save money. Employers may make contributions to your FSA but arent required toA Flexible Spending Account also known as a flexible spending arrangement is a special account you put money.

What is an FSA. Employees in 2021 can again put up to 2750 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. For example if your employer put in 300 and you decided to contribute 600 you have 900.

For example if you earn 45000 per year and allocate 2500 to your FSA for health care. When you have a health or limited-purpose FSA the total amount is available on the first day. Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850.

What is an FSA. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. An FSA is a financial account that employees can fund with pretax contributions.

Funds contributed to the account are. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. 8 You can use the funds in your FSA to pay for qualified medical or dependent-care expenses.

Here are the maximum contribution amounts for 2022. The health FSA contribution limit will remain at 2750 for 2021. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care.

You can contribute up to. FSA maximum 2750 or lower depending on employer. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

What Is The Difference Between A Medical Fsa And An Hsa Healthinsurance Org

Hsa Vs Health Care Fsa Which Is Better For You And Your Employees Insperity

Open An Hsa Or Fsa Healthcare Savings Visa

Hsa Vs Fsa Which One Should You Get District Capital

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Will My Flexible Spending Account Show Up On A W 2

Health Care Fsa Contribution Limits Change For 2022

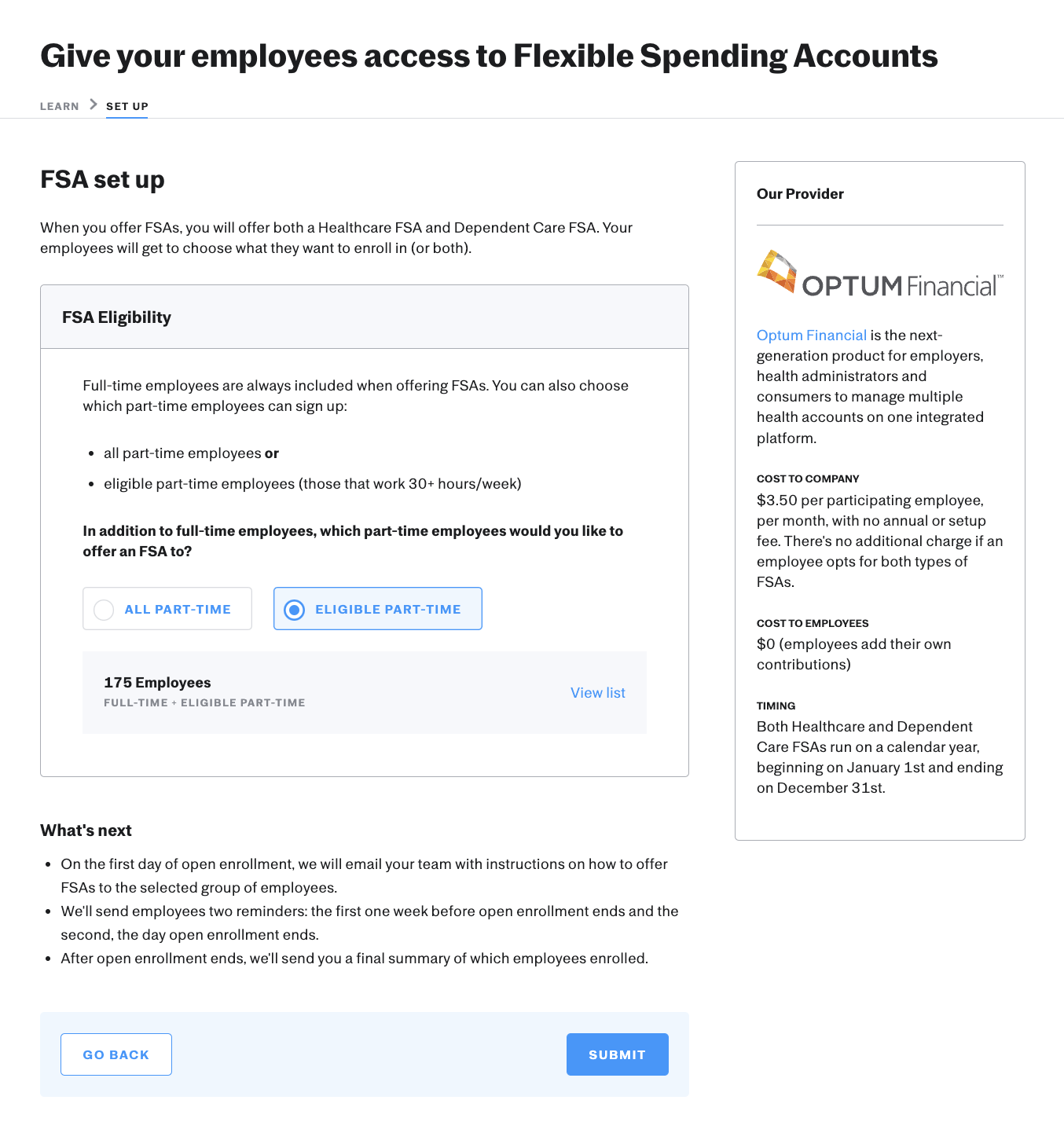

Flexible Spending Accounts Fsa Via Optum Financial Justworks Help Center

Pre Tax To The Max Irs Increases Fsa Contribution Limit For 2019

Why Fsas Are Worth It Even For Low Income Earners

Hsa And Fsa University Of Colorado

/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

Does Money In A Flexible Spending Account Fsa Roll Over

Flexible Spending Accounts Fsa Isolved Benefit Services

2021 Healthcare Fsa Contribution Limit Workest

Open An Hsa Or Fsa Healthcare Savings Visa

Benefit Education Resource Library Navia

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

/flexible-spending-account-fsa-written-on-a-wooden-cubes--1070418618-74ab17cbd81e44fdbd5cf019a02c2593.jpg)